A stylist remarked, “Some clients are drawn to the color, while others are enticed by the reasonable prices.”

Throughout history, there have been periods when silver held more value than gold. However, with the rise of white gold and platinum in the early 20th century, silver’s appeal dwindled. Despite this, silver is now experiencing a surge in demand, particularly in India, where numerous jewelry brands are turning their attention to this metallic hue. But what has spurred this transformation?

From currency to tableware, from electronics to energy, silver has continually found novel avenues to stay in vogue. Yet, within the realm of jewelry, gold traditionally symbolized affluence, relegating silver to a status of “poor man’s gold.”

This narrative is undergoing a profound shift. In 2021, the demand for silver jewelry in India surpassed 600 metric tonnes, according to Statista. The peak demand coincides with festive seasons such as Teej, Onam, Karwa Chauth, Eid, and Diwali. Silver is even beginning to overshadow gold, with global demand projected to reach a record 1.112 billion ounces (340 million kg) in 2022, according to the Silver Institute—a promotional body funded by the silver industry. But why silver?

Aditya Modak, Co-founder of Gargi by Pune-based PN Gadgil and Sons, a legacy gold jewelry dealer of over a century, believes that silver is now captivating consumers’ attention. “Considering the escalating prices of gold and silver’s ability to offer a diverse range well within consumers’ budgets, the demand and value for silver and its products are poised to rise,” he explains. One catalyst for this shift may be the surge in gold prices, which have soared by 25% since March 2020, while silver prices have steadily declined since August of the same year. This prompted medium-term investors to seize the opportunity and invest in silver, including jewelry, coins, and bars, Aditya highlights. The elephant in the room is the pandemic.

Disruption Breeds Opportunity

The COVID-19 pandemic disrupted the gems and jewelry market, dampening demand while gold and silver prices remained high. According to the Silver Institute, the global silver jewelry market suffered during the pandemic, with demand in India hitting a seven-year low. Sanjay Kothari, Vice Chairman of KGK Group, noted in a report for SMBStory in June 2020 that the industry witnessed a decline in foot traffic at jewelry stores, despite the peak wedding season, leading to a halt in mass shopping.

As the pandemic’s effects began to wane, demand for gold jewelry remained subdued due to impending inflation, while consumer interest in silver underwent a transformation.

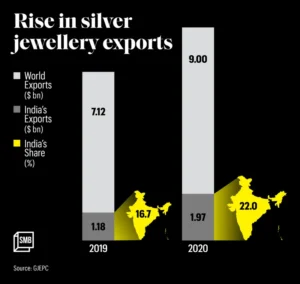

Gross exports of silver jewelry surged over 24% to nearly $2.20 billion (Rs 16,300 crore) in the ten months from April 2021 to January 2022, compared to $1.77 billion (Rs 13,106 crore) during the same period in the previous fiscal year, according to the Gem and Jewelry Export Promotion Council (GJEPC).

Jewelry brands, whether dealing in precious or imitation jewelry, are now recognizing an evolving business opportunity as consumer preferences shift.

All That Glitters Isn’t Gold

After a century of dealing exclusively in traditional gold jewelry, PN Gadgil and Sons launched Gargi Fashion Jewelry to venture into the silver jewelry market. This move is not an anomaly. Prominent imitation jewelry brands like Bengaluru-based Rubans also introduced a line of silver jewelry this year. Chinu Kala, Founder of Rubans, notes that customers now prefer silver jewelry for daily wear and minor occasions. “Previously, silver jewelry was associated more with elaborate ethnic pieces, but in recent years, we’ve seen a rise in minimalistic designs in silver, making it suitable for daily wear,” she explains. This shift allows brands to increase their Average Selling Price (ASP), prompting them to expand their silver collections. Rubans had been working with silver for some time but officially launched its introductory collection just last month. Chinu reveals that due to the overwhelming response, the brand plans to release around 1,000 new designs in the range.

Kolkata-based Paksha By Tarinika, a brand specializing in .925 sterling silver jewelry (containing 92.5% silver by weight) since 2021, also capitalized on this trend. Owner Sunaina Ramisetty expanded the brand’s imitation jewelry label, Tarinika, operational since 2015, to include a silver jewelry wing. “At Paksha, we’ve witnessed sales growth quarter by quarter. Paksha’s growth for FY 2022 is 500%, and we expect it to further increase by the end of this year,” she adds.

Is the Trend Sustainable?

According to global consensus, demand for silver jewelry is expected to grow by 50% year-on-year, with the Silver Institute predicting an 11% growth in 2022 driven by the Indian market. The current untapped potential of silver jewelry exports stands at $1.8 billion. Aditya of PN Gadgil and Sons confirms that customers have begun to realize that owning multiple pieces of jewelry for various occasions with gold is impractical. “We’ve observed a doubling in customer demand for silver jewelry and a 1.5X increase in Gargi’s buyers. Additionally, India is the world’s largest exporter of silver jewelry, according to a GJEPC analysis. With such high demand and a promising future for silver jewelry, brands are not hesitating to shift focus from gold and diamonds to expand their silver portfolios,” he explains.

You can also buy finest silver jwellery from Amazon, through below links:

Sterling Real Silver Bangle for Baby/Kid

Silver Bangles Adorned with Pink and Green Gemstones

Oxidised Silver Necklace Jewellery Set

Clara 925 Sterling Silver Jules Pendant Earring Chain Jewellery Set